Inflation for Dummies

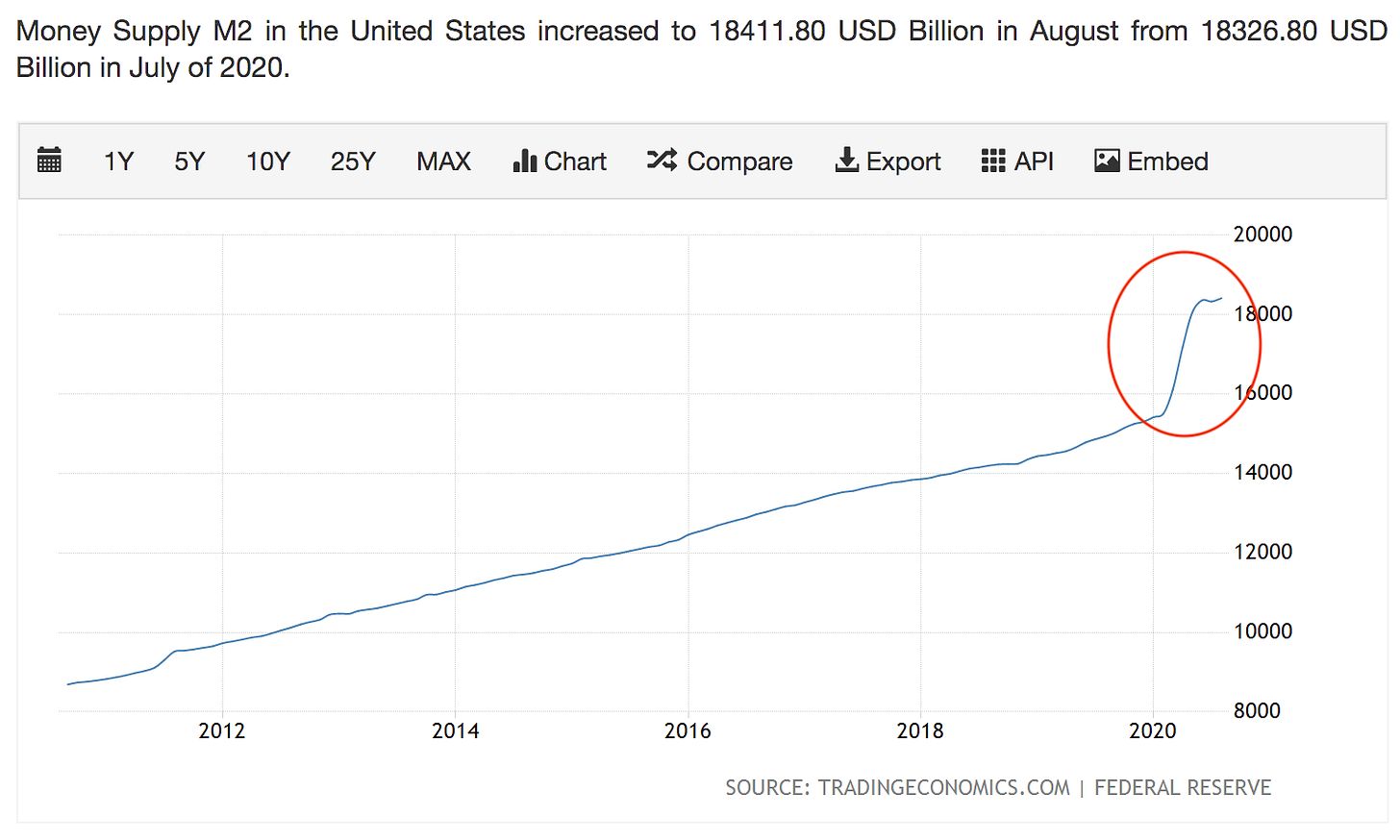

Most economists agree that excessive growth of the money supply creates very high rates of inflation.

60-second Summary

Most economists agree that excessive growth of the money supply creates very high rates of inflation. And guess what governments have been doing a lot of recently? Excessively growing the money supply.

Tell Me More

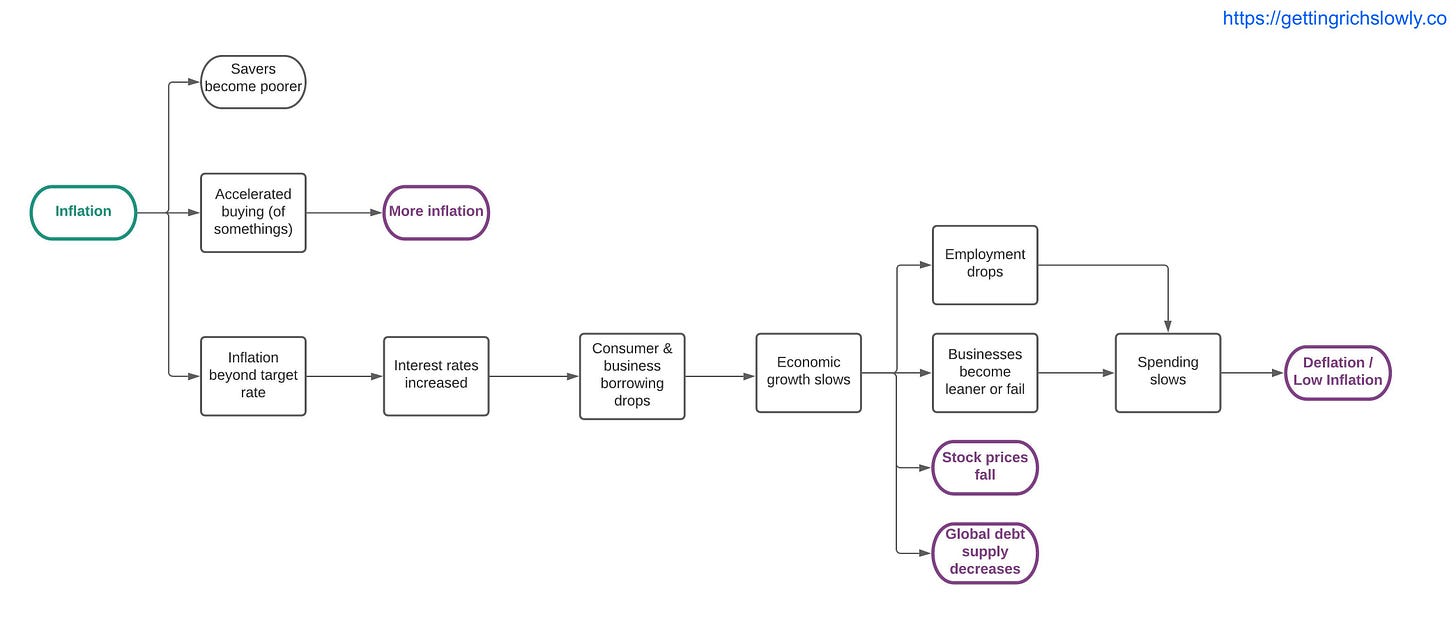

Inflation is not necessarily a bad thing. It’s a consequence of a growing economy and at low levels is considered healthy. The real issue is: whilst we know what inflation is, even the greatest economists of all time can’t predict rates of in/deflation. Nor can they prescribe measures to precisely control it.

Our inability to precisely manipulate the rate of inflation has been an issue for a while. It’s a complicated topic so take a gander at the simplified view of some causes of inflation below.

There are many books, papers, and articles on how to manage inflation. And yet, for the past decade (at least!) the Western world has had trouble getting inflation to behave as they want it to (as has Japan). Inflation has remained incredibly low, and on the face of it, this is great for the consumer. Goods and services remain cheap, so everyone keeps on buying.

The issue is that adjusting interest rates is a key (the key?) tool in controlling inflation.

If inflation is high, increase rates to slow growth and therefore, inflation. If inflation is low, drop rates to stimulate spending. But what happens if rates are already rock bottom AND inflation is also rock bottom, AND you’re in the middle of a global economic event? You can’t drop rates much (or at all), and so one of your primary tools to stimulate your economy is defunct. Rates can go into negative territory, but we know very little about what long-term consequences that will have. And so you start printing money. Lots of it. This money looks for homes - new purchases, propping businesses up, the stock market, new business ventures etc. But then it turns out that that wasn’t enough. So you print more money—lots of it. And you hope that that’ll do the trick, because you’re literally out of options.

And so, this is where we find ourselves today. Our governments have created a lot of new debt, just as we were approaching the top of the longest bull run in history (which itself has made a lot of new debt). They are hoping that this, in turn, will increase inflation, allowing them to raise rates once again. And higher rates would provide headroom for one of their primary tools.

The questions you should be asking yourselves though are:

How and who is going to pay back all this debt?

If we’ve had so much trouble increasing the rate of inflation, how do we know we can control it when it starts to rise?

My answer to both questions is, “I don’t know”. And probably neither does anyone else.

How Can I Make Money From This?

The stock market and the economy consist of cycles. And cycles within cycles. It is impossible to know how long those cycles will last, but with some research and experience, you can learn the stages of those cycles.

Inflation hasn’t arrived yet (not in earnest). But when it does, some sectors will do better than others. Value stocks tend to come back into favour (vs growth stocks). Many investors adjust their strategies from capital-growth to capital-preservation. Although, there will be nuggets of growth if you know where to look for them. For example, if inflation is high, and banks aren’t lending, I would expect to see businesses and individuals seek out crowdfunding. Overall, if you can anticipate how the game will change, you can front-run the rest of the market.

🖖

If you’d like to give me some feedback just hit reply to this message. And if you’d like to see more content like this, then please subscribe below (or follow me on etoro).